Website: http://swift360pays.com/

Warned By: US Securities and Exchange Commission

Overview of Swift360pays Review:

Watch out!

There might be a scammer latching on to you just as you read this sentence. With the latest technology, we often take the internet for granted and choose to look over the harmful effects of the internet. Scams have a common way of finding their victims. Some of them are – clicking on random links of emails, downloading attachments, participating in a random quiz that asks for your personal information, cold calls telling you about the benefits of opening an account with their brokerage firm. Do you want to avoid these scams? If your answer to this question is yes, then read the Swift360pays review and find out what you should look for in a broker before opening an account with them. If you find this Swift360pays review useful, make sure to share it with your loved ones to save them from such scams as well.

What all should you look for in Swift360pays Review?

Scams are deadly.

Having the potential to make someone go into a debt trap, the scammers lure their victims in with irresistible offers and discounts. In this segment, we will be telling our readers about a few important points that you must look for in a broker before opening an account with them. Remember, nobody has a right over your money.

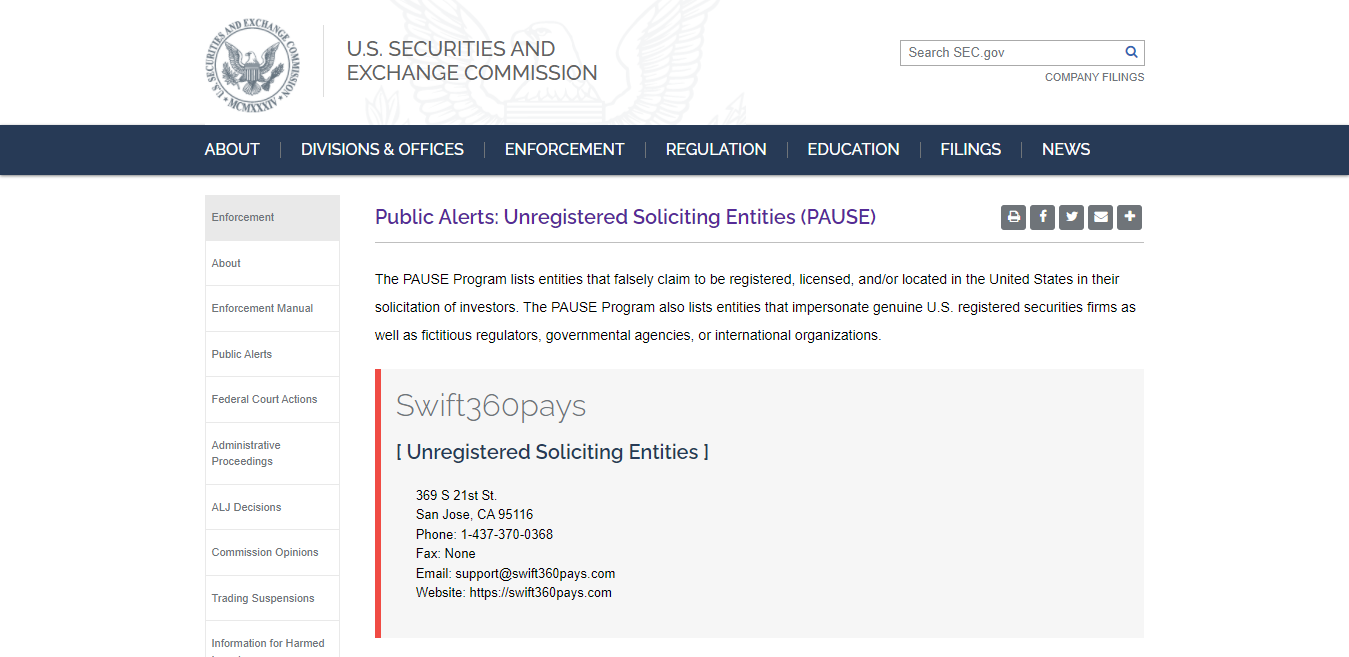

Swift360pays and Regulation:

The regulation is one of the most significant checkpoints that one must look for while searching for a brokerage firm. With the increasing inflow of scammers in the market, the regulations set up barriers to ensure the scammers stay away from the market. For this, they introduced the licenses. To acquire a license, the broker must go through some tests. However, these tests are not as easy as they might sound. If a company does not have a license, it means it is UNAUTHORISED and not fit for trading. In our case, if Swift360pays is unregulated, then this raises the first red flag against Swift360pays in this Swift360pays review. Read More Scam Broker Reports 2022.

Swift360pays and Minimum Deposit:

The minimum deposit is generally asked in small amounts by the legitimate brokers as taking huge amounts as the minimum deposit is not advised by the regulations. However, the tradition of taking huge minimum deposits is common in scam brokers as their main aim is to steal as much money as they can from the trader before they get suspicious. The usual amount asked by the legitimate brokers lies in the range of $5 to $10. If Swift360pays asks for an amount more than the average, chances are that Swift360pays is a scam.

Swift360pays and Leverages:

Leverage is yet another common checkpoint that one must look for while checking for a broker online. Due to their direct involvement with the risk, leverages are offered in small amounts. The leverage is even capped at 1:30 and 1:50 in the European countries and the USA respectively. If Swift360pays offers leverage more than this, it is a sign that Swift360pays is a potential scam.

Conclusion: Is Swift360pays scam or legit?

To sum up, all that has been said above, we give you the power to decide whether Swift360pays is a scam or not. We request the readers to move forward with extreme caution. If you have been a victim of Swift360pays scam or any other broker, do not feel embarrassed. File a complaint right now and get instant help from our team!

Get Chargeback

What is Chargeback?

A chargeback is the refund of a charge made by using different installment techniques like – credit card, wire move, and so on. It licenses you to get your assets back for fraudulent allegations.

If you are a victim of fraud, the question that concerns you is how to get your lost assets back? Chargeback is the answer for that. By using Chargeback services like Scam Victims Help, you can collect a cautious chargeback case to get your assets back as fast as could be possible.